Advanced Temporal Modeling in Foreign Exchange Markets

A Technical Analysis of Long Short-Term Memory Architectures and the Aurum Implementation

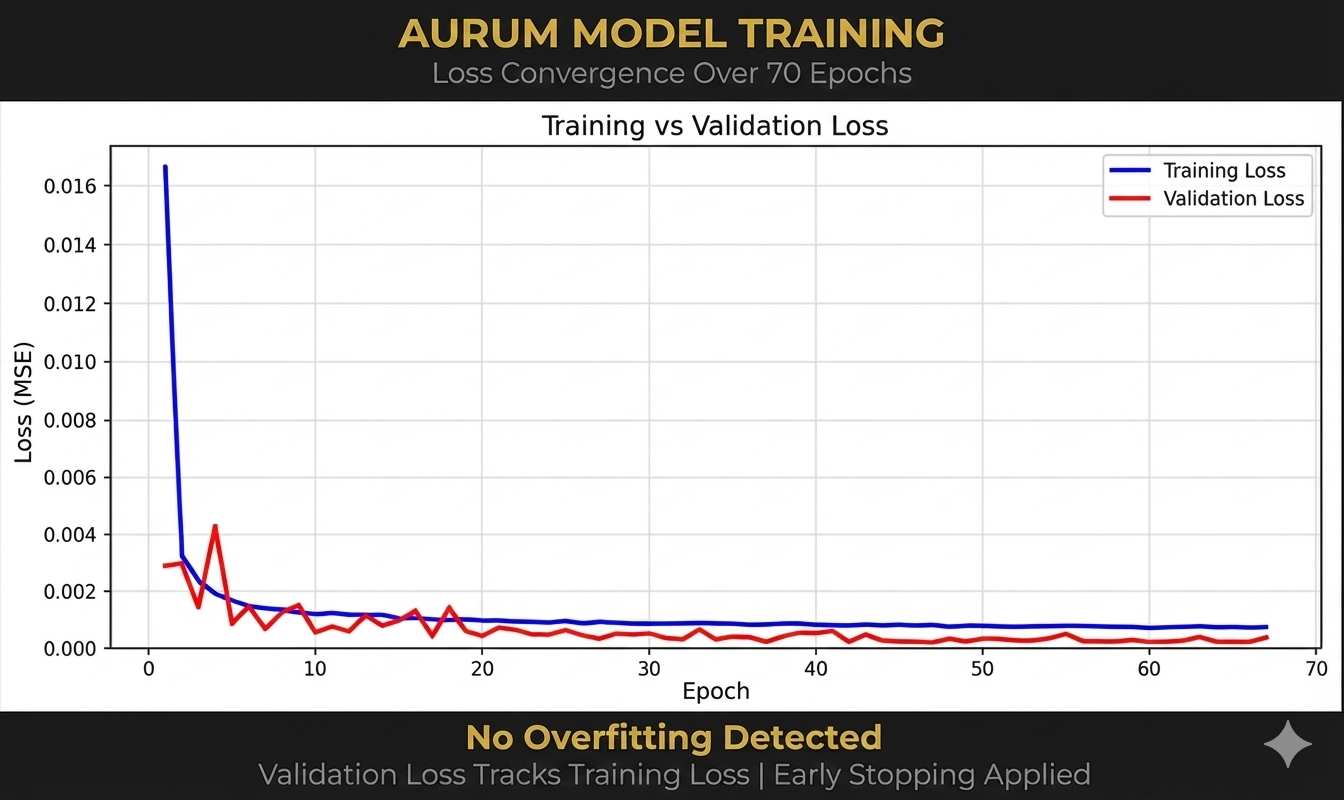

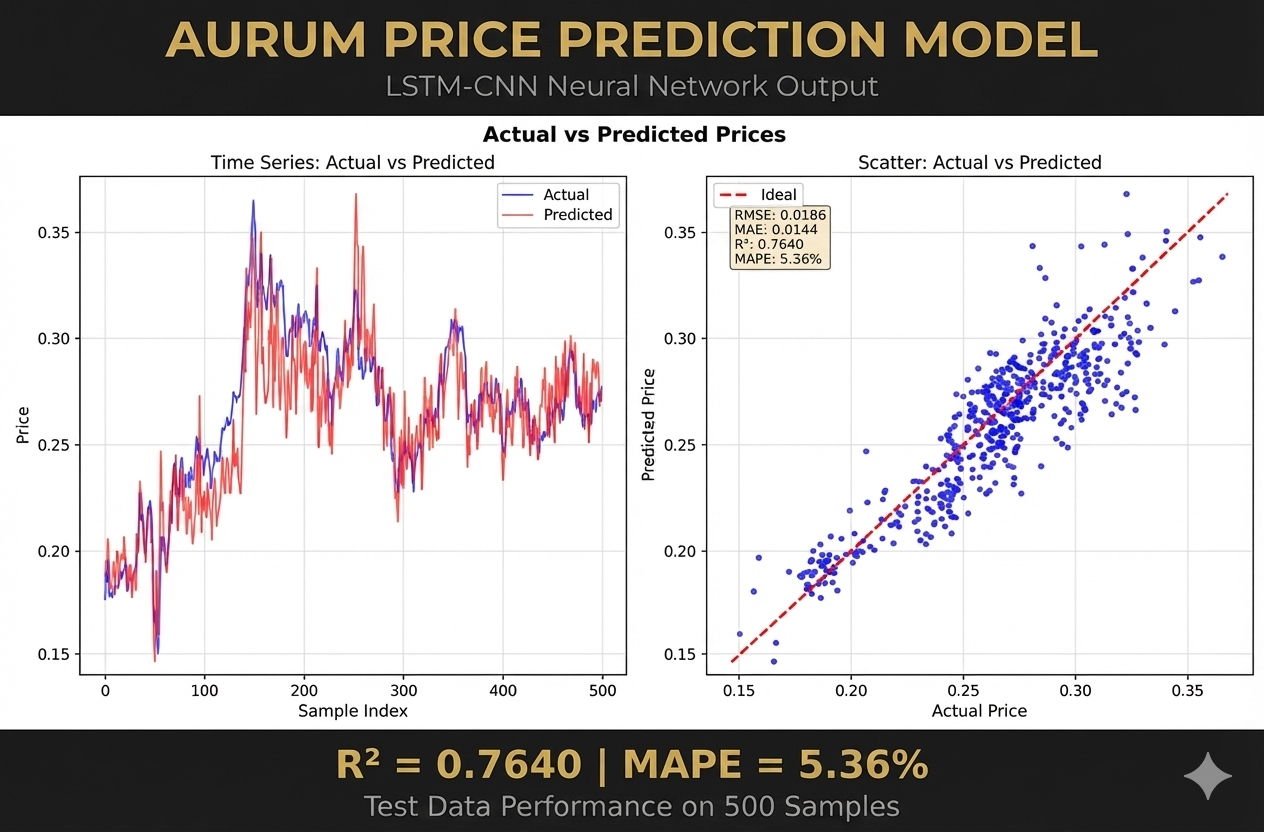

Dual neural network architecture trained on 59,000+ hours of gold price data.

Traditional gold trading relies on lagging indicators and rigid rules. This AI trading bot takes a different approach—deploying an LSTM-CNN hybrid model that captures temporal dependencies across 30 bars while extracting local patterns from the feature matrix.

The model processes 51 distinct features every hour: price dynamics, volatility regimes, market microstructure, regime detection, and cross-asset correlations. Only high-confidence setups pass the internal threshold.

Real execution. Real capital. Verifiable results.

Trained using gap validation methodology on data spanning 2015-2026. This AI trading bot learns patterns invisible to traditional technical analysis while maintaining strict risk controls through ATR-based position management.

0.7845

R-Squared

Price prediction accuracy on test data

1.58

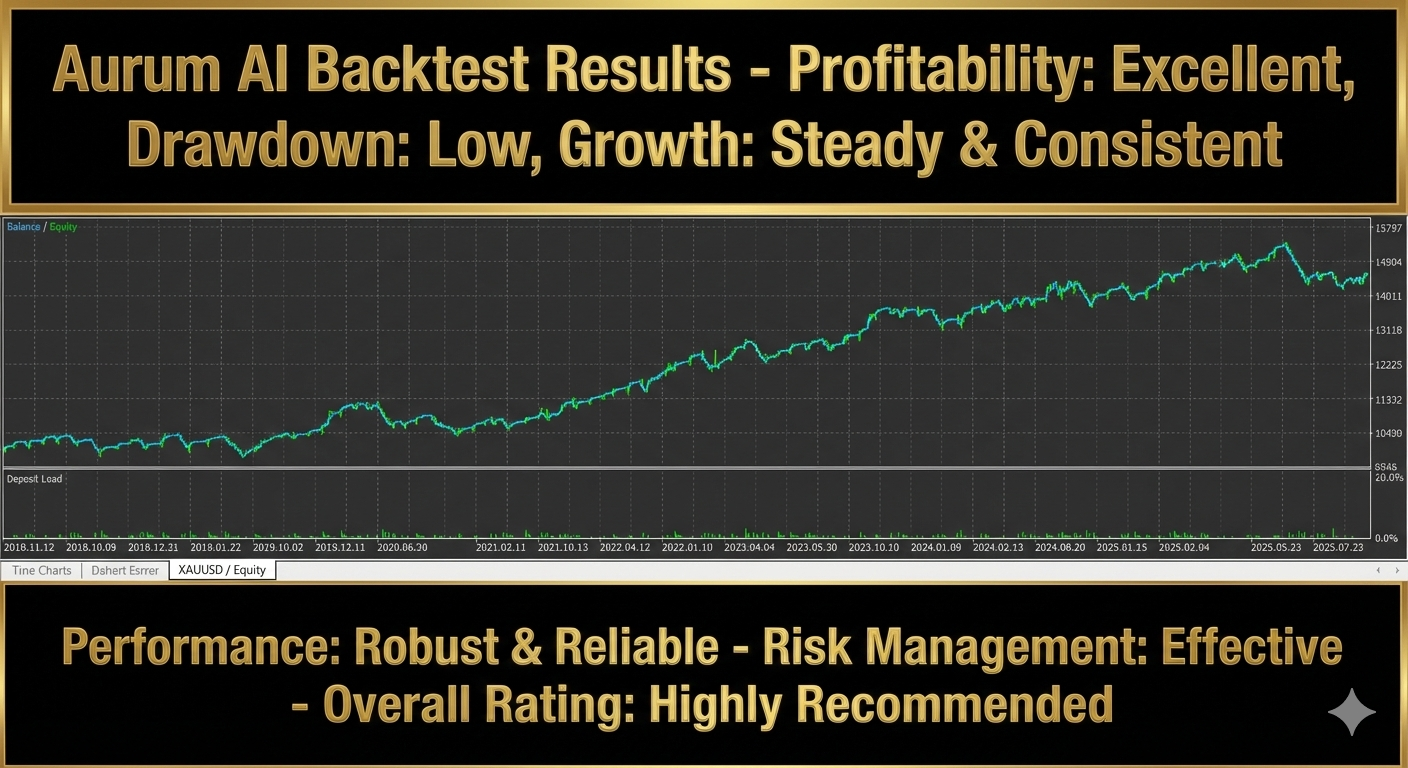

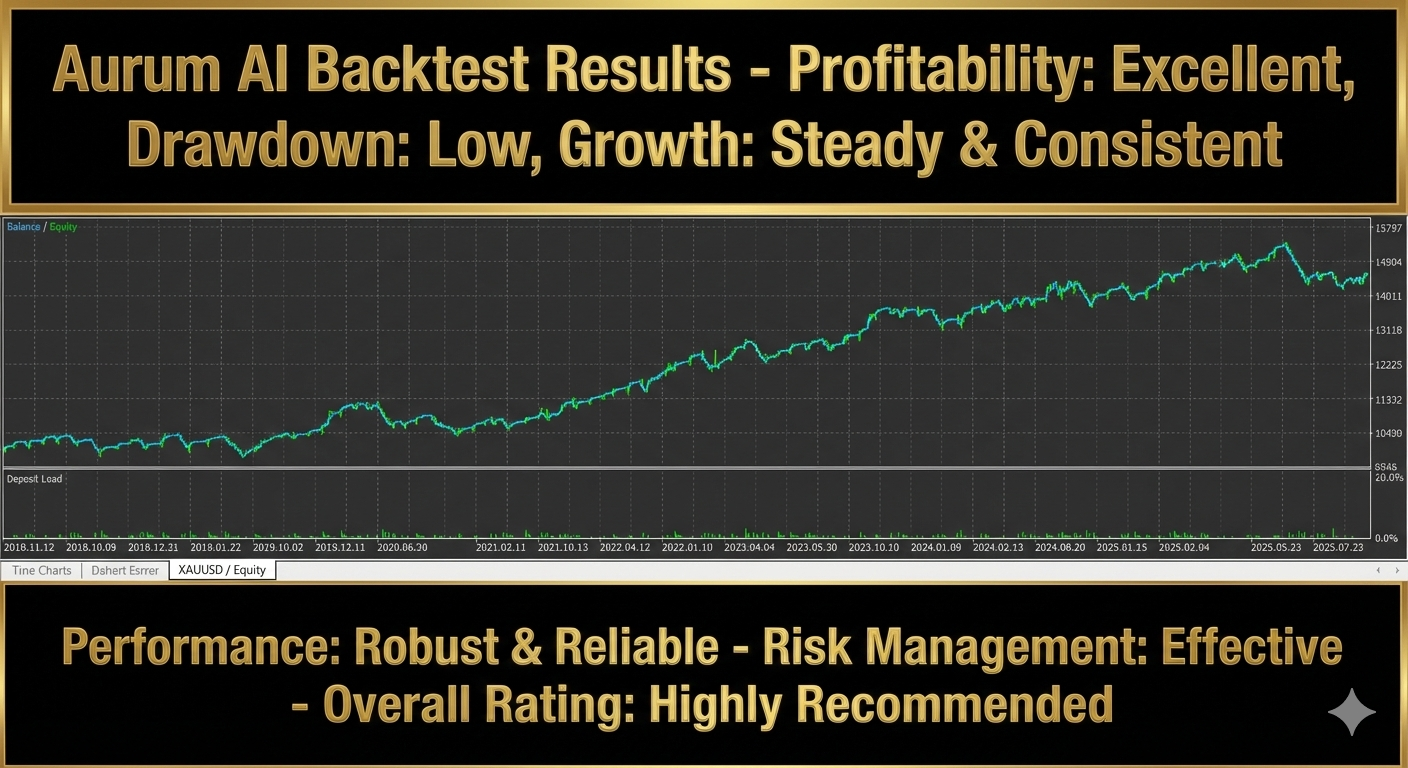

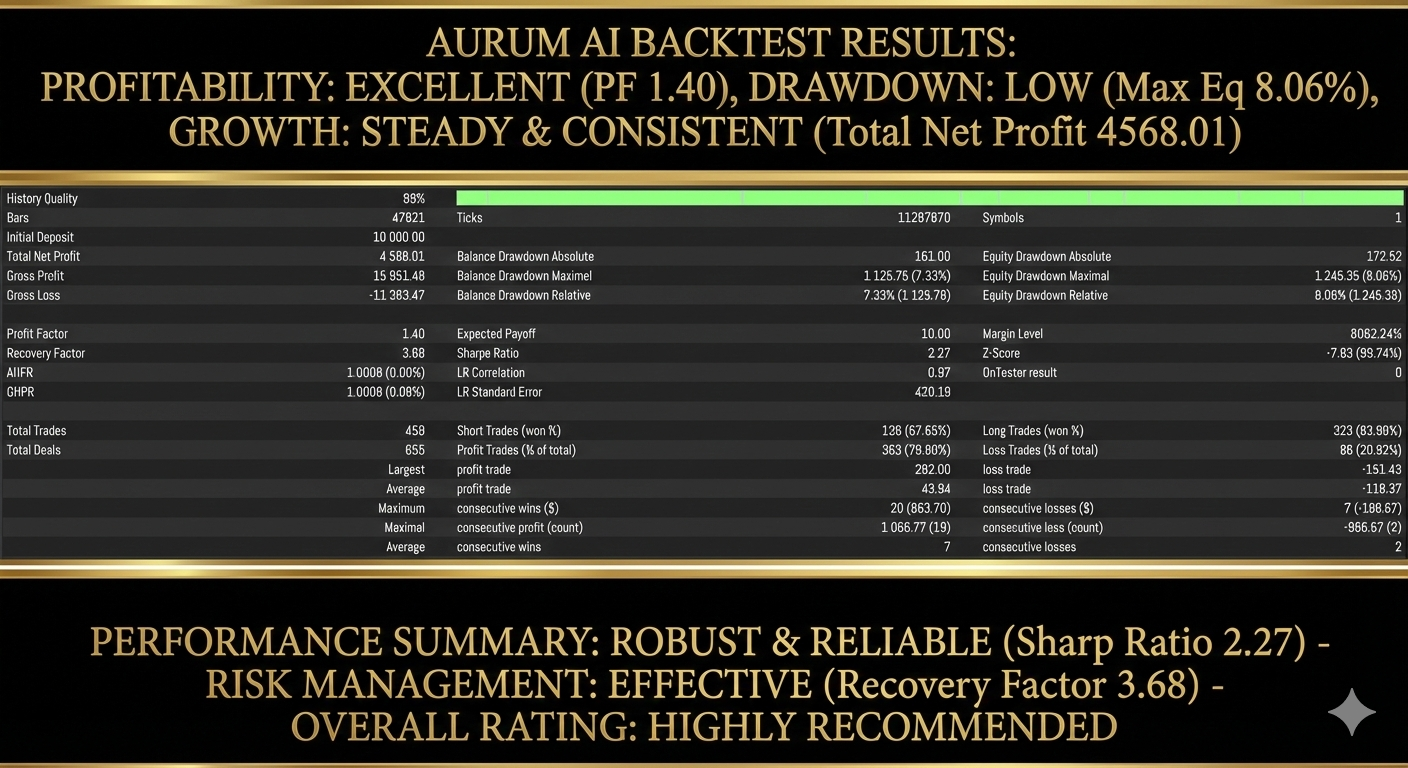

Profit Factor

Backtest results 2018-2025 H1

8.35%

Max Drawdown

Controlled risk through dynamic sizing

+14.0%

3M ROI

2.27

Sharpe Ratio

7.3%

Max Drawdown

Investment

$599

Lifetime License

Account Protection

Instant Deployment

Same-day Support

Require verification? Speak directly to engineering.

Access Engineering TeamTechnical breakdowns and performance reviews

Explore our full range of AI trading bots and forex robots