Unlock Precision

Mastering Rangex for Automated Range Trading Success

Chop transformed into calculated conquest.

In ranging markets, traders succumb to analysis paralysis—chop devours resolve, whipsaws erode confidence. This forex robot thrives where others bleed, extracting profits from the lateral grind.

The sideways market is where amateur capital burns. While you wait for trends that never come, the range extracts its toll—death by a thousand cuts, each one a failure of discipline.

Real execution. Real capital. Verifiable results.

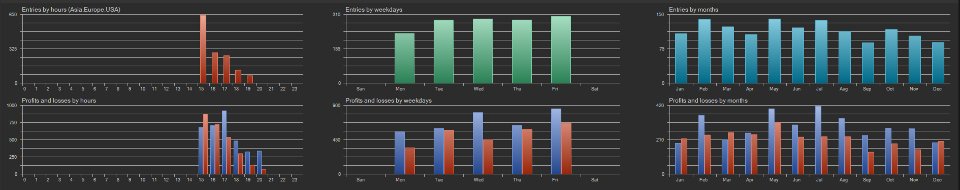

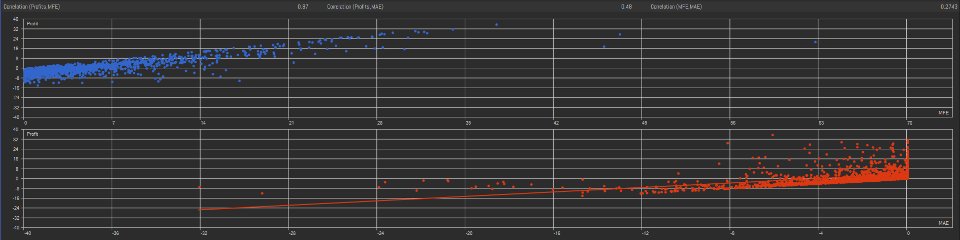

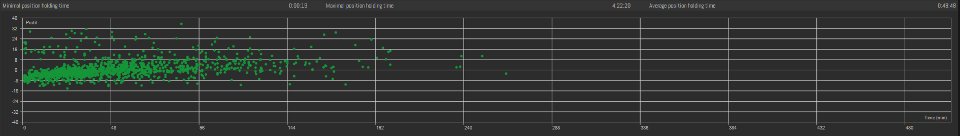

Witness the systematic mastery—drawdown stabilized at 4.1%, trade frequency disciplined to 15 per month, range breaks captured with precision exits. Variance harnessed, not suffered.

4.1%

Drawdown Stability

Controlled through precise range boundaries

15/month

Trade Discipline

Systematic extraction from consolidation

10-33 pips

Range Parameters

Validated size for high-probability setups

+12.4%

3M ROI

1.87

Sharpe Ratio

2.1%

Max Drawdown

Investment

$220

Lifetime License

Account Protection

Instant Deployment

Same-day Support

Require verification? Speak directly to engineering.

Access Engineering TeamTechnical breakdowns and performance reviews

Explore our full range of AI trading bots and forex robots