The Algorithmic Edge-Scalpex

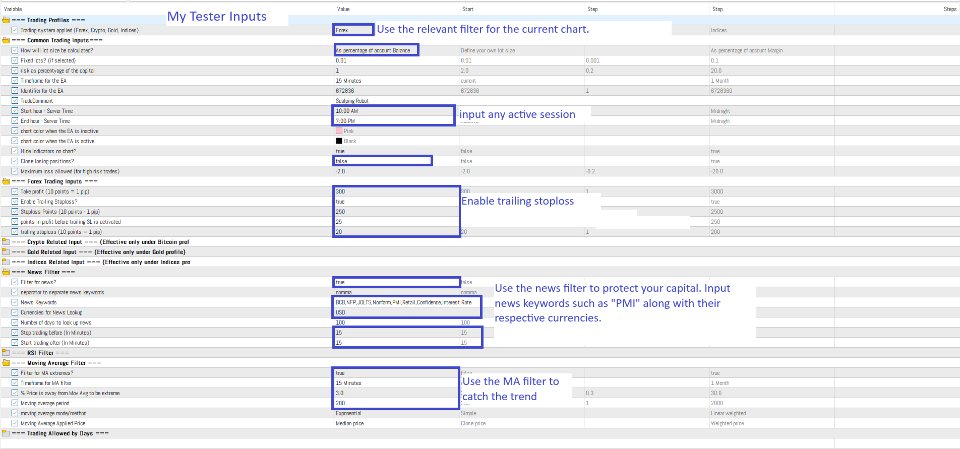

A Technical Deep Dive into Scalpex for M15 Breakouts

Zero-latency execution capturing opportunities human reflexes miss.

In volatile arenas, human latency is fatal—reflexes lag, opportunities vanish in milliseconds. This forex robot operates at speeds your biology cannot match, capturing breakouts before you can blink.

The market moves faster than your neurons can fire. By the time you recognize the opportunity, it has already been captured by algorithms operating at speeds your biology cannot match.

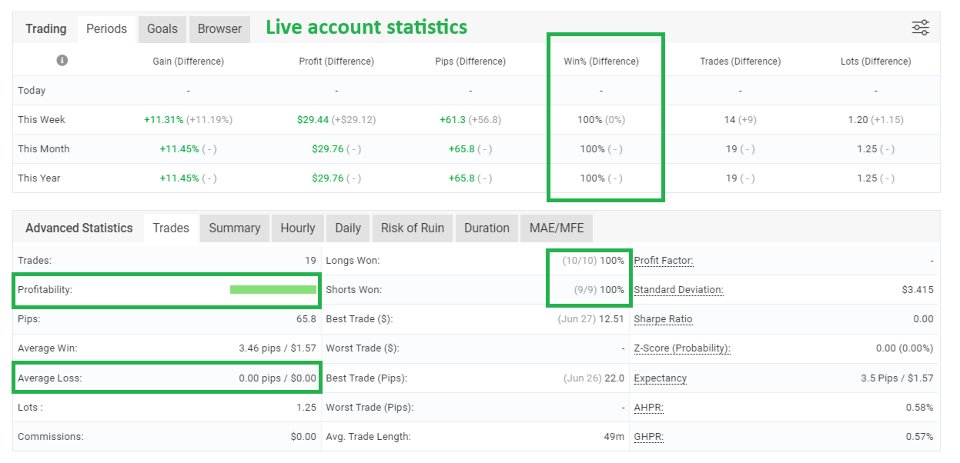

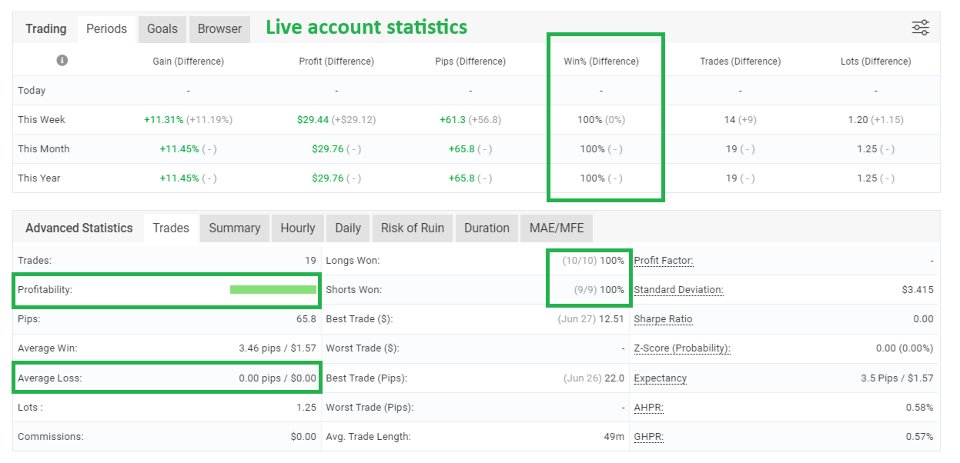

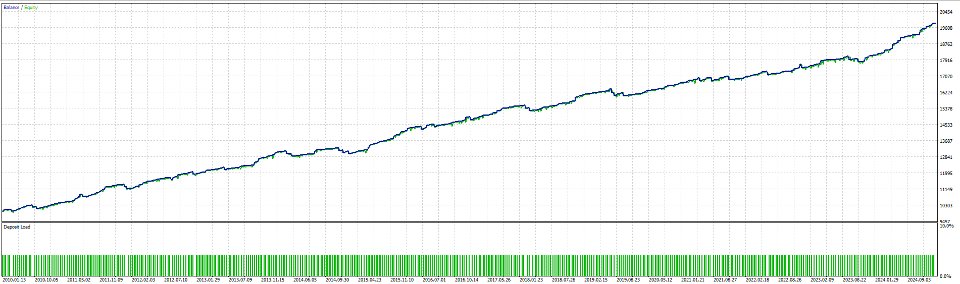

Real execution. Real capital. Verifiable results.

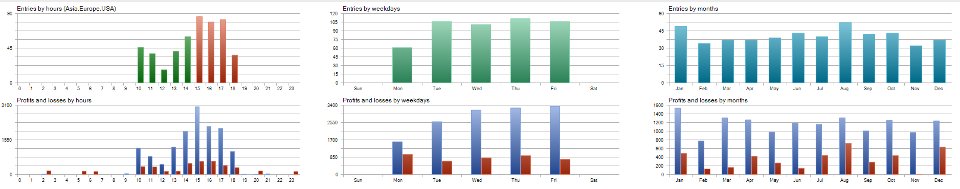

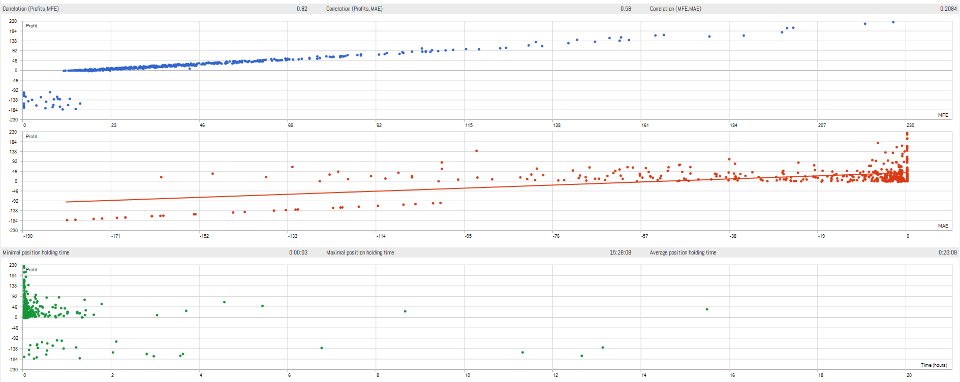

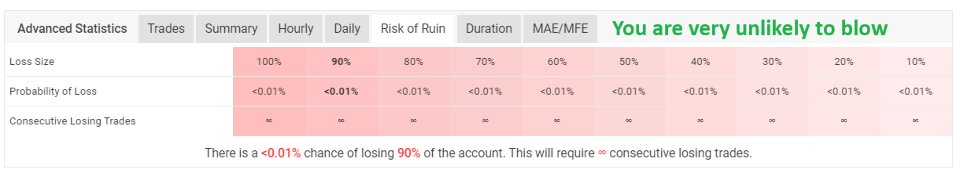

Observe the relentless velocity—drawdown mitigated at 5.2%, trade frequency accelerated to 45 per week, pending orders executed with zero latency. Variance conquered through speed.

5.2%

Drawdown Mitigation

Risk controlled at velocity

45/week

Trade Velocity

Capturing opportunities human reflexes miss

Zero latency

Execution Speed

Pending orders eliminate human delay

+15.7%

3M ROI

2.34

Sharpe Ratio

3.2%

Max Drawdown

Investment

$300

Lifetime License

Account Protection

Instant Deployment

Same-day Support

Require verification? Speak directly to engineering.

Access Engineering TeamTechnical breakdowns and performance reviews

Explore our full range of AI trading bots and forex robots