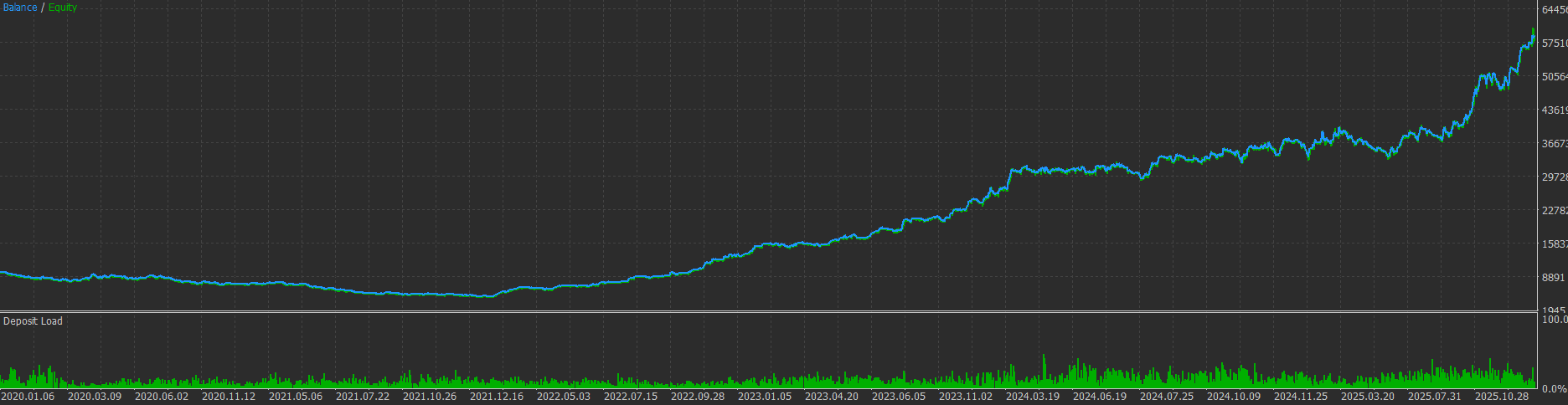

Image 1: Equity curve for the product ArchonV3

You've seen the ads. "AI trading bot makes $10,000 per month on autopilot." Screenshots of perfect equity curves. Testimonials from traders who quit their jobs.

Then you buy one. And within weeks, your account is down 40%.

This isn't bad luck. It's the predictable result of choosing an AI trading bot based on marketing instead of substance. The forex robot market is flooded with systems that look impressive in backtests but collapse the moment they touch live markets.

Here's how to tell the difference before you spend a dollar.

The 7 Critical Factors for Evaluating AI Trading Bots

1. Verified Live Performance (Not Just Backtests)

Backtests are fiction. They're optimized on historical data, which means the bot already knows what happened. It's like predicting yesterday's lottery numbers.

What matters is forward testing—performance on data the bot has never seen.

What to look for:

- •

Myfxbook or FXBlue verified accounts

- •

At least 3-6 months of live trading history

- •

Consistent performance across different market conditions

- •

Third-party verification, not just screenshots

Red flag: If a vendor only shows backtests or refuses to provide live verification, walk away. There's a reason they're hiding it.

2. Realistic Drawdown and Risk Metrics

Any bot can show 500% returns if it risks 50% of your account on every trade. The question is: what did it risk to get there?

Key metrics to evaluate:

- •

Maximum Drawdown: How much did the account drop from peak to trough? Anything over 25% is aggressive. Over 40% is gambling.

- •

Sharpe Ratio: Risk-adjusted returns. Above 1.0 is acceptable. Above 2.0 is excellent.

- •

Profit Factor: Gross profit divided by gross loss. Below 1.5 is marginal. Above 2.0 is strong.

- •

Recovery Factor: Net profit divided by max drawdown. Shows how quickly the system recovers from losses.

Red flag: Vendors who only show profit percentages without drawdown data are hiding something. High returns with low drawdown is rare—if they claim both, demand proof.

3. Transparent Strategy Logic

You don't need to understand every line of code, but you should understand what the bot does and why it works.

Questions to ask:

- •

What market conditions does it trade? (Trending, ranging, breakouts?)

- •

What timeframes and pairs does it support?

- •

How does it determine entry and exit points?

- •

What risk management rules are built in?

For AI/ML bots specifically:

- •

What type of model is it? (LSTM, CNN, ensemble, etc.)

- •

What features does it use for prediction?

- •

How was it trained and validated?

- •

Is there overfitting protection?

Red flag: "Proprietary algorithm" with zero explanation is a cop-out. Legitimate developers can explain their approach without revealing trade secrets.

4. No Dangerous Trading Strategies

Some strategies look profitable until they blow up your account in a single day.

Avoid bots that use:

- •

Martingale: Doubling down after losses. Works until it doesn't—then you lose everything.

- •

Grid trading without stops: Opens multiple positions hoping price returns. Can accumulate massive losses in trending markets.

- •

Averaging down: Adding to losing positions. Turns small losses into account-ending disasters.

- •

No stop loss: Any system without defined risk per trade is a ticking time bomb.

What to look for instead:

- •

Fixed risk per trade (1-2% maximum)

- •

Hard stop losses on every position

- •

Maximum daily/weekly drawdown limits

- •

News filter to avoid volatility spikes

5. Proper Validation Methodology

How a bot was tested matters as much as the results.

Good validation practices:

- •

Out-of-sample testing: Performance on data not used for optimization

- •

Walk-forward analysis: Sequential testing across multiple time periods

- •

Gap validation: Training and testing on non-overlapping data

- •

Monte Carlo simulation: Testing robustness across randomized scenarios

Red flag: If the vendor can't explain their validation methodology, the backtest is probably curve-fitted garbage.

6. Ongoing Support and Updates

Markets change. A bot that worked in 2024 might fail in 2026. You need a developer who actively maintains their system.

What to look for:

- •

Regular version updates with changelogs

- •

Responsive customer support

- •

Active user community or forum

- •

Clear documentation and setup guides

Red flag: No updates in 6+ months, no way to contact support, or a "set and forget" sales pitch. Markets evolve—your bot should too.

7. Reasonable Pricing and Business Model

Price isn't everything, but it tells you something about the vendor's confidence and business model.

Pricing models to consider:

- •

One-time license: You own it forever. Good for proven systems.

- •

Subscription: Ongoing access with updates. Aligns vendor incentives with your success.

- •

Performance fee: Vendor takes a cut of profits. Strongest alignment, but rare.

Red flag: Extremely cheap bots (5,000+) often rely on hype over substance. The sweet spot is typically $200-800 for quality systems.

AI Trading Bots vs Classical Forex Robots

Not every automated system uses machine learning. Understanding the difference helps you choose the right tool.

AI/ML Trading Bots:

- •

Learn patterns from historical data

- •

Adapt to changing market conditions (if properly designed)

- •

Can process complex, non-linear relationships

- •

Require more computational resources

- •

Risk of overfitting if not properly validated

Classical Forex Robots:

- •

Rule-based systems with fixed logic

- •

Transparent and predictable behavior

- •

Easier to understand and troubleshoot

- •

May struggle when market regimes change

- •

Generally more robust to overfitting

Which is better? Neither, inherently. A well-designed classical EA can outperform a poorly-trained ML model. The methodology matters more than the technology.

Red Flags That Should Make You Run

Beyond the specific factors above, watch for these warning signs:

- •

Guaranteed returns: No legitimate system guarantees profits. Markets are uncertain by definition.

- •

"Limited time offer" pressure: Scarcity tactics are manipulation, not marketing.

- •

No refund policy: Confident vendors offer trials or money-back guarantees.

- •

Fake reviews: Check if testimonials appear on multiple unrelated products.

- •

Unrealistic equity curves: Perfect 45-degree lines don't exist in real trading.

- •

Hidden fees: Broker requirements, VPS costs, or "premium" features not disclosed upfront.

How to Test Before You Commit

Even after vetting a bot, test it yourself before risking real capital.

Testing protocol:

Demo account first: Run for at least 2-4 weeks on demo

Small live account: Start with minimum capital you can afford to lose

Monitor actively: Don't "set and forget" until you trust the system

Compare to claims: Does live performance match what was advertised?

Scale gradually: Only increase capital after consistent results

The Bottom Line

Most AI trading bots fail because they're built to sell, not to trade. Flashy marketing, cherry-picked backtests, and unrealistic promises attract buyers—but they don't make money in live markets.

The bots that actually work share common traits: verified live performance, transparent methodology, proper risk management, and developers who stand behind their product.

Do your due diligence. Demand proof. Test before you trust.

Your capital deserves better than a marketing gimmick.

Looking for AI trading bots and forex robots that meet these standards? Explore our verified trading systems with live performance data, transparent methodology, and ongoing support.