Image source: Gemini

Today I'd like to share my story: how I managed to break into algorithmic trading.

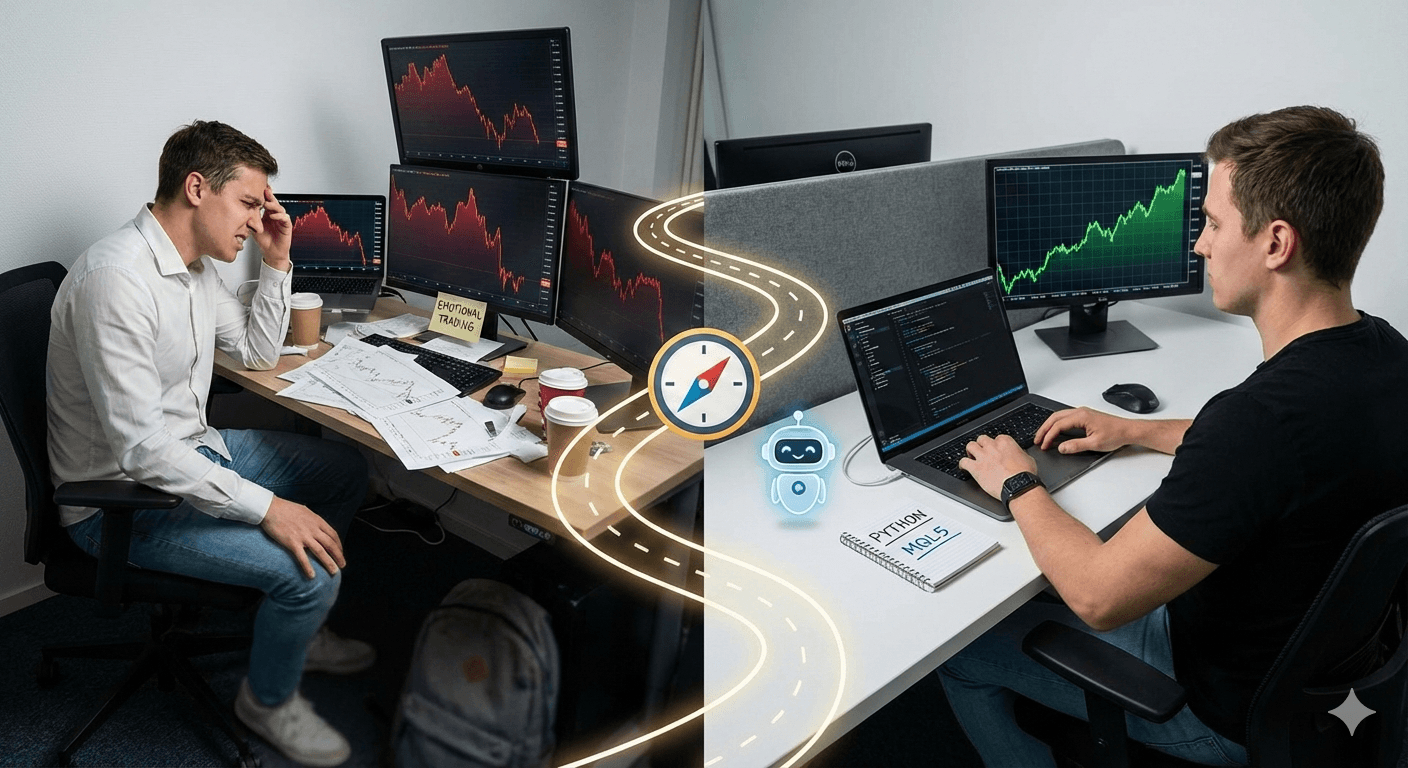

First of all, I'm not a software developer by profession. I decided to get into algorithmic trading for reasons of my own. I needed to solve the emotional fatigue that came with staring at charts and constantly breaking the discipline of letting the markets take their course.

I struggled a lot with emotional regulation. I would move targets, deviate from strategies, and break my own rules. Almost every time, I'd regret it—especially when trades I had modified went in favor of my original placement. It was disheartening, and I knew I needed a solution, fast.

Back then, I had little idea what algorithmic trading really was, or how to get started. Through YouTube, I learned that MT4 and MT5 have an IDE, and I started playing around with it back in 2021. I followed tutorials, learned syntax quickly by coding along with others, and wrote simple scripts and EAs on my own until I got the hang of it.

At the time, it felt revolutionary.

What I didn't realize was how much time and effort it actually takes to write production-level code that's safe to run in live environments. Naively, I rushed into deploying simple EAs on prop firm challenges (which, by the way, I now think are mostly a scam). I never passed a single one. In fact, I just wasted money.

What I Learned Over Time

Over the years, I've learned that—contrary to what I once believed—algorithmic trading is not a convenience scheme where you deploy a robot, go on vacation, and make millions while chilling on a beach in Miami.

Not even close.

Yes, it's useful—especially for removing emotional bias—but it requires consistent effort. You need to:

- •

Continuously improve your algorithms

- •

Read a lot of documentation

- •

Stay informed about new approaches and techniques

- •

Actively maintain and evolve your systems

Another big lesson was the importance of forward testing on live demo accounts. Relying purely on backtests makes you a sitting duck in live markets. Things like:

- •

Spreads

- •

Slippage

- •

Latency

…are critical factors that strategy testers simply can't replicate accurately.

On Learning MQL5

Above all, passion and dedication are vital. Learning to code your own systems is incredibly challenging, especially with the steep learning curve that comes with MQL5, which is very similar to C++.

At the beginning, object-oriented programming felt like Greek to me.

Over time, though, I developed a deep appreciation for the language. I now have a collection of header files with reusable classes and structures that I can literally plug into almost any EA I build. This makes development much easier, because I can focus mainly on the strategy, while most of the heavy lifting is handled elsewhere.

Things like:

- •

Trade management

- •

Position sizing

- •

Stop-loss and take-profit calculations

- •

Market regime analysis

- •

Neural networks

- •

Fuzzy scoring

…are all handled by custom header files using classes. All I need to do is instantiate those classes and call their methods inside the EA's event handlers.

Python & Machine Learning

Python has also been incredibly useful, especially for machine learning—a topic I'll share more about later. One of my biggest "wow" moments was discovering that you can run neural network models directly inside MQL5 using ONNX Runtime.

That completely eliminated the need for inference servers, as well as the headaches and costs of deploying PyTorch or Keras models externally.

Breaking into algorithmic trading wasn't easy, and it certainly wasn't the passive income dream I once imagined. But the journey taught me discipline, structure, and a deep respect for what it takes to build systems that actually work in live markets.

If you're thinking about starting this path, know that it's challenging—but if you're curious enough and willing to put in the time, it's one of the most rewarding technical challenges you can take on.