Expert Advisor Details

ArchonV3

1.3.6

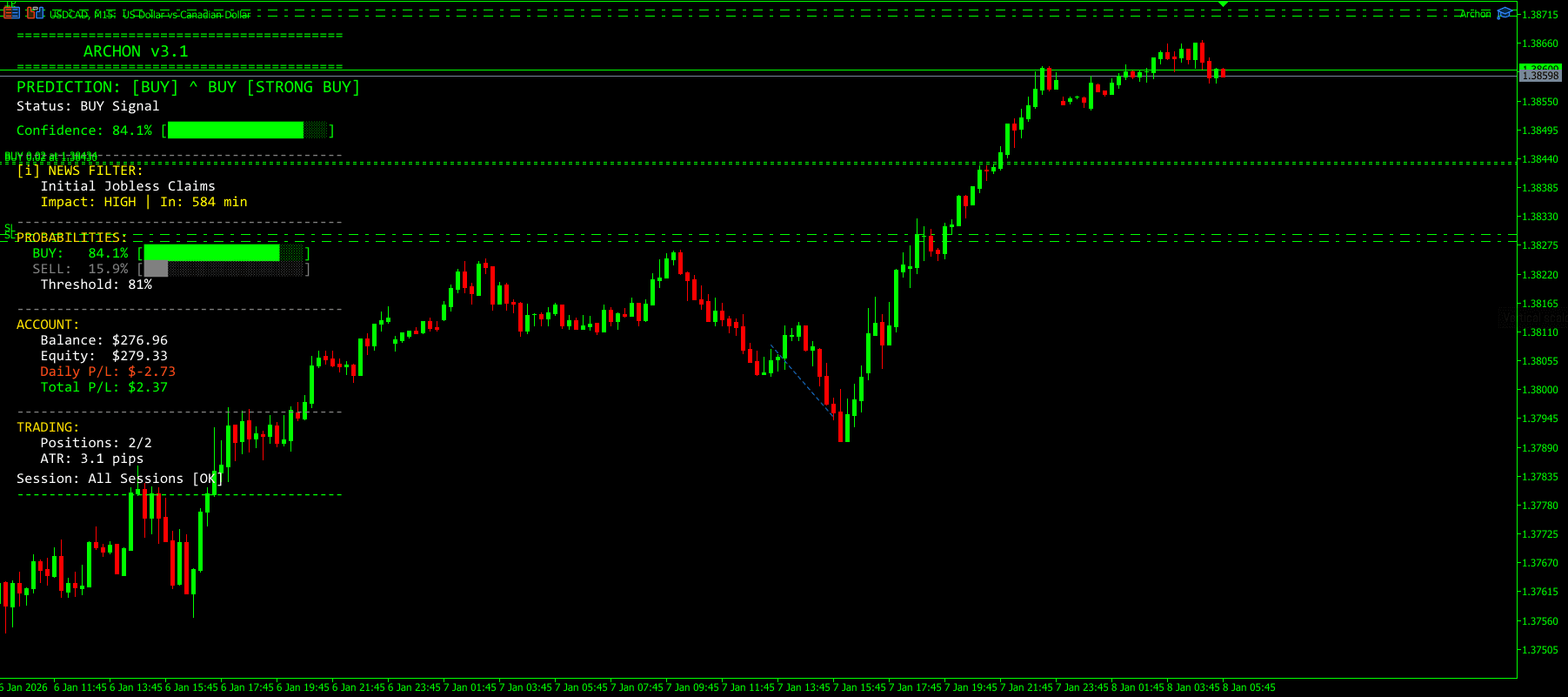

ArchonV3 attached to a live USDCAD chart

Get a free demo of ArchonV3 on the MQL5 marketplace

The Problem Archon Solves

Most Expert Advisors fail not because of poor entries, but because of primitive exit logic. Traditional EAs rely on static rules—fixed take-profits, naive trailing stops, or indicator-based exits that ignore changing market conditions.

Markets are non-linear and regime-dependent. Volatility expands and contracts, trends mature and decay, and liquidity shifts across sessions. A static exit cannot adapt to these dynamics.

Archon takes a fundamentally different approach. Instead of hardcoding exits, it combines machine-learning–driven trade selection with a state-aware, adaptive exit engine designed to manage trades intelligently after entry.

System Architecture Overview

Archon is built as a layered decision system:

Feature Engineering Layer — Converts raw market data into structured features

Prediction Layer — Generates high-confidence trade signals

Trade Management Layer — Actively manages risk, exits, and exposure

┌─────────────────────────────────────────────────────────────┐

│ ARCHON ARCHITECTURE │

├─────────────────────────────────────────────────────────────┤

│ Raw Market Data (M15, H1, H4) │

│ │ │

│ ▼ │

│ Feature Engineering → 56 structured features │

│ │ │

│ ▼ │

│ ML Prediction (ONNX XGBoost) → Confidence score │

│ │ │

│ ▼ │

│ Trade Manager → Dynamic exits, trailing, risk overrides │

└─────────────────────────────────────────────────────────────┘

Feature Engineering: The 56-Feature Matrix

Raw OHLC data is insufficient for machine learning. Archon transforms price into a multi-dimensional representation of market state.

Base Timeframe Features (M15)

- •

Price action geometry (body, wicks, normalized close)

- •

Momentum and trend (RSI, MACD, ADX, EMA slope)

- •

Volatility (ATR, Bollinger Band width)

- •

Temporal context (hour of day, day of week)

Higher Timeframe Context (H1 & H4)

Higher timeframe features prevent false precision by enforcing structural alignment.

- •

Trend direction and strength

- •

Momentum confirmation

- •

Volatility regime detection

Advanced Institutional Features

- •

Support & resistance distance and strength

- •

Smart Money Concepts (order blocks, BOS, CHOCH, FVGs)

- •

Candlestick pattern confidence scoring

- •

Chart pattern detection and completion metrics

The Prediction Engine

Archon uses gradient-boosted decision trees (XGBoost) exported to ONNX and executed natively inside MetaTrader 5.

Crucially, Archon is optimized exclusively for USDCAD and XAUUSD. Each instrument has its own dedicated model trained on its historical behavior.

Gold’s volatility structure and USDCAD’s session-driven tendencies are fundamentally different—and Archon treats them as such.

Trades are only allowed when model confidence exceeds 81%, ensuring that the exit engine works with high-quality inputs rather than noisy signals.

Advanced Exit & Trade Management Engine

Where Archon truly differentiates itself is in post-entry trade management.

Instead of fixed take-profits, Archon uses a layered exit framework that adapts as the trade evolves.

Dynamic Stop Loss Initialization

Initial stop loss placement is volatility-aware, using ATR-based distance rather than fixed pips. This prevents premature exits during normal price expansion while maintaining strict risk limits.

Multi-Mode Trailing Stop System

Once a trade moves into profit, Archon transitions control to its trailing engine:

- •

Chandelier Exit — ATR-based trailing aligned with trend strength

- •

Swing Structure Trailing — Moves stops to validated swing highs/lows

- •

Fixed Distance Trailing — For controlled or ranging conditions

- •

Percentage-Based Trailing — Scales protection relative to achieved profit

Market-State-Aware Exit Logic

Trailing behavior adapts dynamically based on:

- •

Volatility contraction or expansion

- •

Momentum decay

- •

Structure breaks or failed continuations

This allows profits to run during strong directional moves while tightening risk aggressively during consolidation or reversal risk.

Hard Risk Overrides

All exit logic is subordinate to global risk controls:

- •

Daily loss limits

- •

Maximum drawdown protection

- •

Session and time-based trade termination

If risk thresholds are breached, all positions are closed immediately—no exceptions.

Trailing Stop Modes

Chandelier Exit — N × ATR below/above extreme

Swing High / Low — Structure-based trailing

Fixed Pips — Constant distance trailing

Percentage — Profit-relative trailing

Symbol Auto-Detection

Archon automatically detects whether it is attached to USDCAD or XAUUSD and loads the correct prediction model and exit logic.

Broker-specific symbol suffixes are handled automatically, ensuring compatibility across environments.

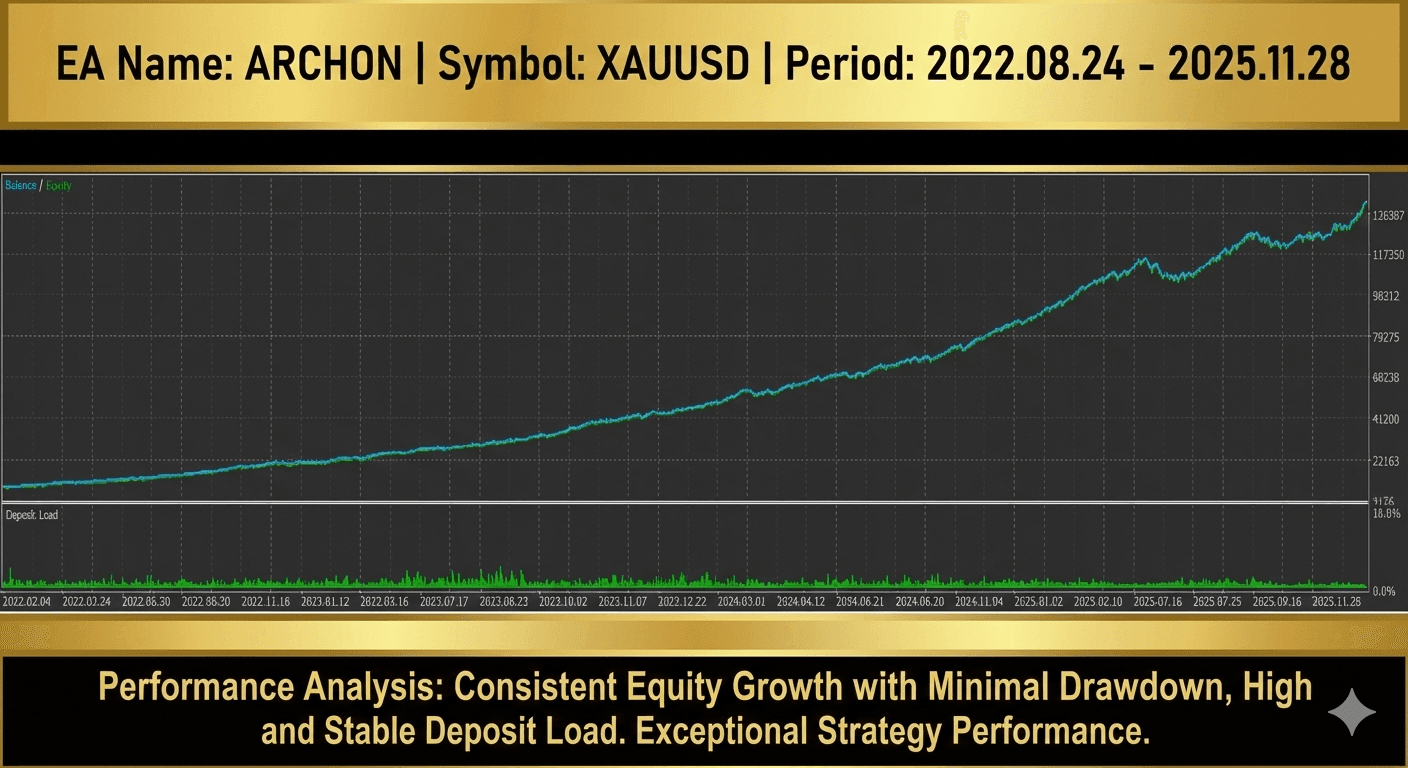

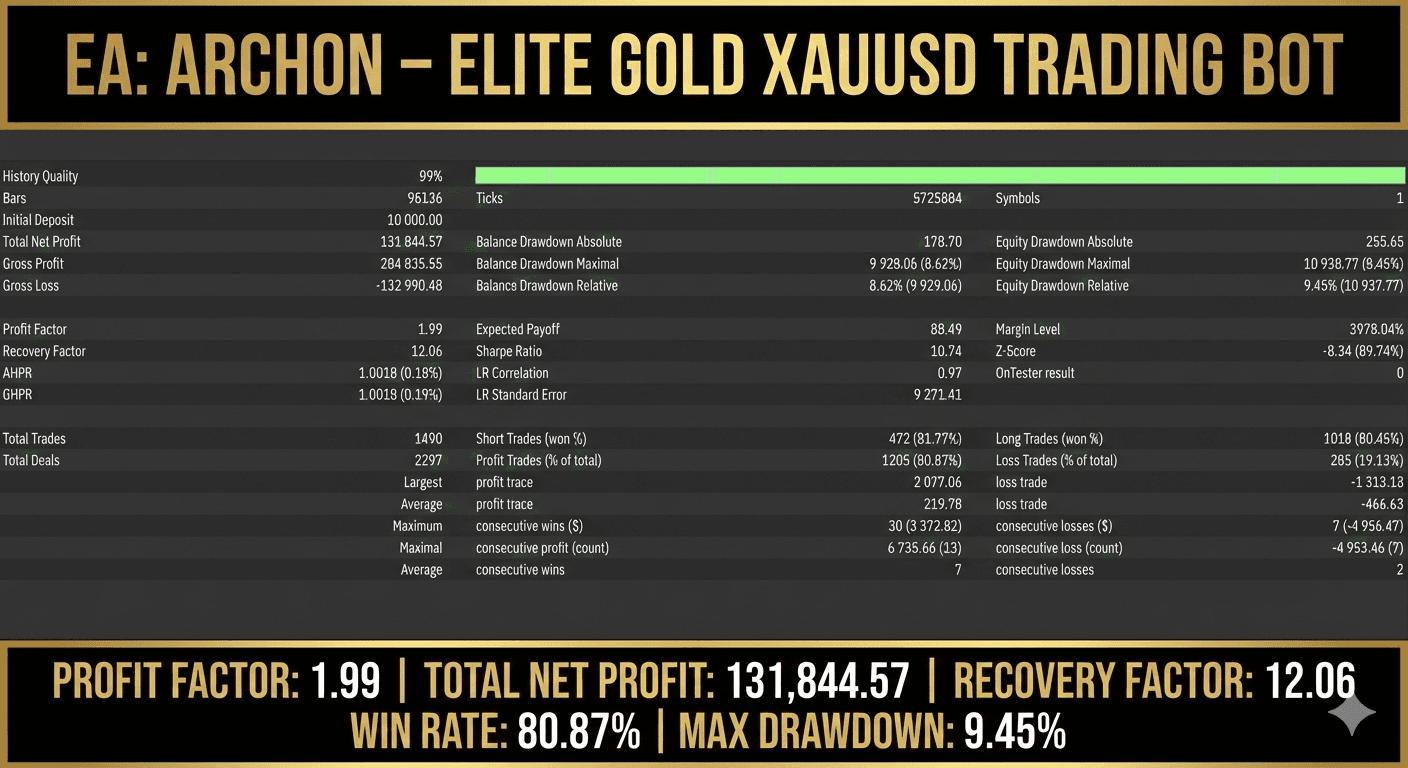

Performance Characteristics

Based on 5-year historical testing (2020–2025) on USDCAD and XAUUSD:

- •

Selective trade frequency

- •

Above-average trade duration

- •

Profitability driven primarily by exit efficiency

Archon is not a scalper. It is a precision trade management system designed to extract maximum value from correct market positioning.

Why This Architecture Works

Instrument-specific specialization

Exit-driven profitability, not signal overfitting

Multi-timeframe structural confirmation

Volatility-aware risk and exit logic

Fully embedded execution with zero external dependencies

Archon is not just an entry algorithm—it is a complete decision and exit framework engineered for real market conditions.

© 2026 Auron Automations. All rights reserved.