The global foreign exchange market has undergone a fundamental transformation with AI and machine learning agents replacing traditional trading methods, exemplified by sophisticated systems like Archon v3 that process $7.5 trillion in daily liquidity through autonomous frameworks capable of real-time adaptation and complex risk-mitigation protocols.

Image by freepik

The AI Revolution in Foreign Exchange Markets

The global foreign exchange market, processing upwards of $7.5 trillion in daily liquidity as of 2022 benchmarks, has undergone a fundamental structural transformation heading into 2026. The traditional dichotomy between institutional high-frequency dominance and retail discretionary participation is rapidly dissolving, replaced by a sophisticated ecosystem of artificial intelligence and machine learning agents.

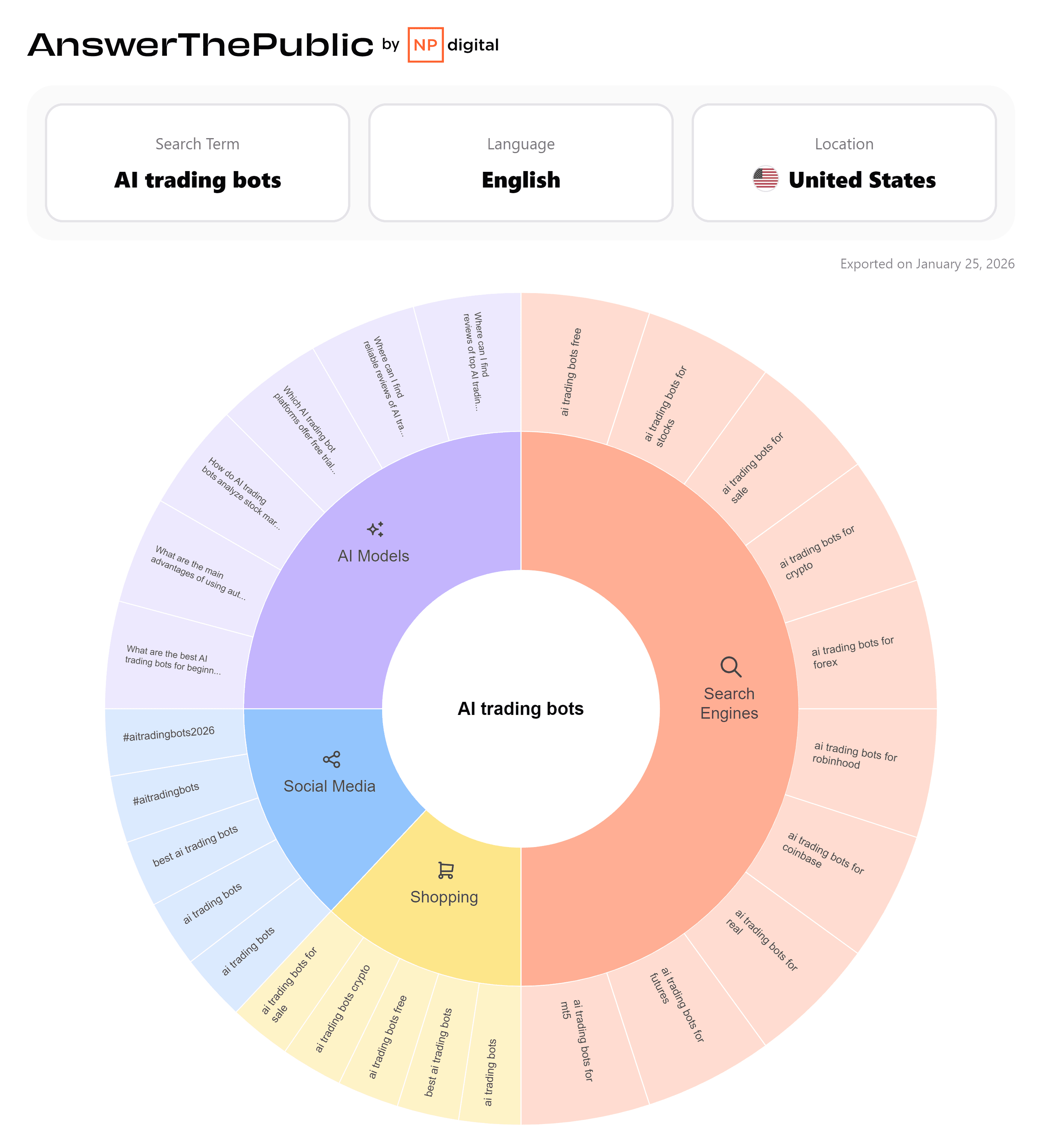

Within this technological frontier, the search for "forex ai trading" has become a central node for both market participants and technological developers. Search metrics from the United States market indicate a stable interest baseline with a monthly volume of 210, contributing to a global interest pool of 700. While the keyword difficulty is currently rated as a relatively accessible 25%, the underlying search intent is predominantly informational, suggesting that market participants are transitioning from the "awareness" phase of automated trading to a deeper "evaluation" phase.

Market Dynamics and Competitive Landscape

The current competitive landscape for AI-driven forex solutions is characterized by a high density of informational queries and a relatively low barrier to entry for authoritative content. The cost-per-click for "forex ai trading" averages $3.14, reflecting a moderate competitive environment where specialized fintech providers can achieve significant organic visibility.

SEO Metric | Value (US Focus) | Strategic Implication |

|---|---|---|

Monthly Search Volume | 210 (Local) / 700 (Global) | Sustainable interest requiring deep-funnel content |

Keyword Difficulty | 25% (Easy) | Opportunity for high-authority technical reports |

Search Intent | Informational | Users prioritize guides and architectural deep-dives |

Competitive Density | 0.52 | Moderate competition; favors detailed performance data |

Average CPC | $3.14 | Viable for targeted lead generation in retail sector |

Data from late 2025 reveals that algorithmic trading now handles nearly 89% of the world's total trading volume. This near-total dominance by automated systems has shifted the retail trader's focus from "beating the market" to "aligning with the dominant algorithms".

Technical Evolution: From Expert Advisors to Machine Learning Agents

The evolution of automated forex trading is often misunderstood as a linear progression of speed. In reality, it is a paradigm shift in decision-making logic. Traditional algorithmic trading, often embodied in the Expert Advisors of the MetaTrader 4 era, relies on static, rule-based execution. These systems function on boolean logic: if a 50-day moving average crosses a 200-day moving average, execute a trade.

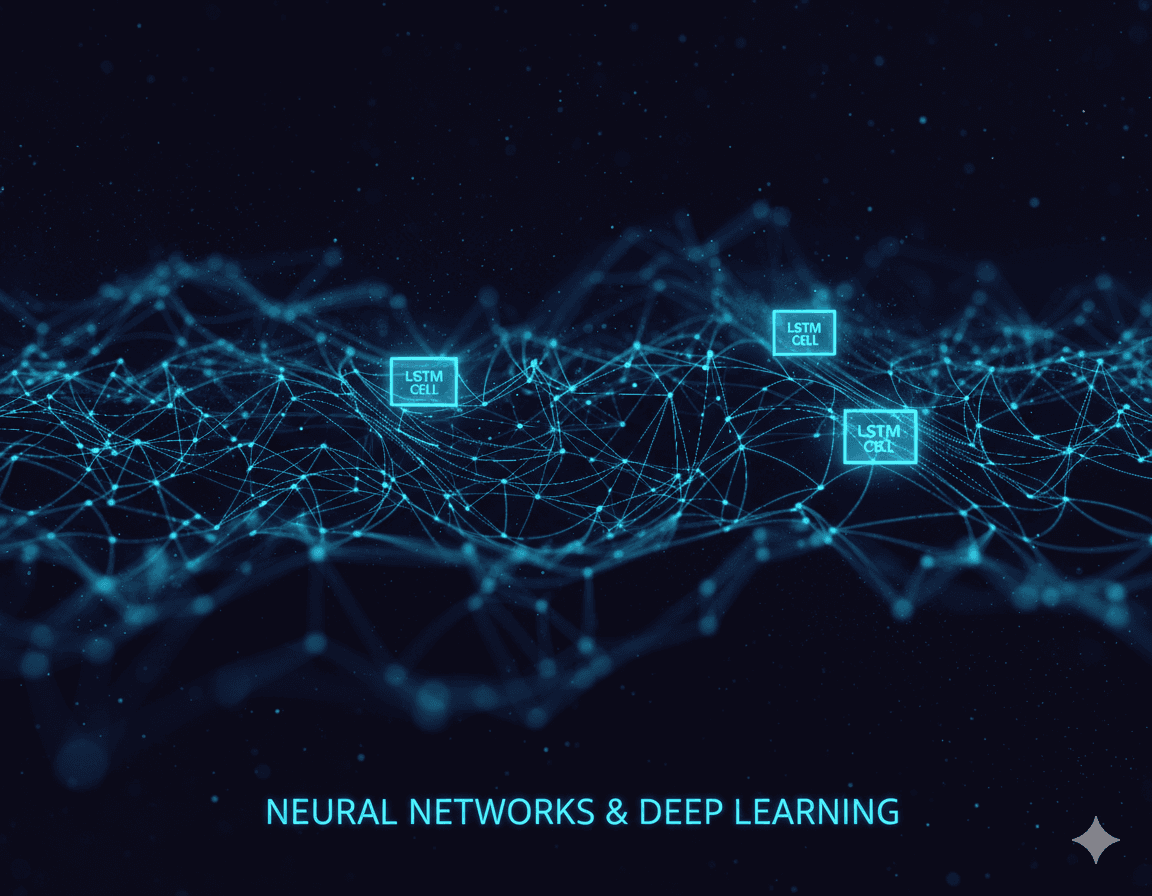

Modern AI trading, by contrast, utilizes neural networks and ensemble learning to derive patterns from vast datasets that are invisible to the human eye or static rules. As we move into 2026, the focus has shifted toward Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) units, which are uniquely suited for the time-series forecasting required in currency markets.

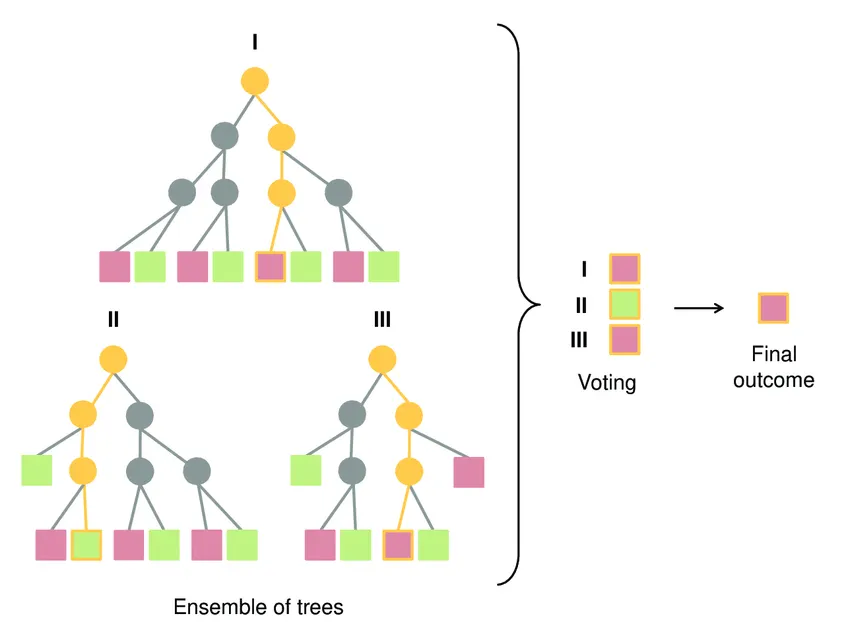

Ensemble Methods and Gradient Boosting: The Archon v3 Architecture

A critical development in 2025 is the refinement of ensemble methods, specifically gradient-boosted decision trees (GBDT), as seen in the Archon v3 system. While deep learning often receives the most media attention, GBDT models frequently outperform neural networks on structured, tabular market data.

The mathematical foundation of gradient boosting involves an iterative process where new models are added to correct the errors of existing models. The Sharpe Ratio, a critical metric for evaluating performance, is mathematically expressed as:

Where:

- •

is the expected portfolio return

- •

is the risk-free rate of return

- •

is the standard deviation of the portfolio's excess return

Feature Type | Specific Indicators Analyzed | Archon v3 Implementation |

|---|---|---|

Trend Analysis | ADX, Moving Averages, MACD | Evaluates momentum across three timeframes |

Oscillators | RSI, Stochastic, CCI | Identifies overbought/oversold exhaustion points |

Volatility | Average True Range (ATR), Bollinger Bands | Dynamically adjusts stop-loss and take-profit levels |

Market Structure | Support/Resistance, Order Blocks, Liquidity | Mimics "Smart Money Concepts" used by institutions |

Competitive Analysis: Platform Comparison

The competitive landscape in 2026 is bifurcated between "hands-off" managed AI platforms and "self-directed" AI tools. AlgosOne has positioned itself as a leader in the former category, utilizing a multi-layered AI architecture to democratize institutional-grade trading for the average retail investor.

Dukascopy and Forex.com, by contrast, focus on providing the infrastructure for automation rather than a singular proprietary AI "black box". This highlights a growing trend: while beginners gravitate toward the high APY claims of managed platforms, professional traders prefer systems that offer transparency and local control.

Platform | Core AI Philosophy | Target Audience | Key Performance Claim |

|---|---|---|---|

AlgosOne | Fully automated, cloud-based "Black Box" | Passive Investors | >80% Win Rate; Tiered ROI |

Archon v3 | GBDT-powered local execution (MT5) | Prop Traders / Semi-Pro | Rigorous 5-year backtest; 81% Threshold |

Dukascopy | API-centric, Strategy Builder focus | Developers / Quant Traders | Institutional-grade Swiss pricing |

Risk Management: The Financial Bodyguard Approach

In 2026, the consensus among professional traders is that risk management is not just a feature—it is the strategy itself. AI systems are increasingly viewed as "financial bodyguards" that prevent the psychological pitfalls common to retail trading, such as "revenge trading" or "FOMO".

Dynamic Position Sizing and Drawdown Control

Modern AI trading bots utilize dynamic position sizing based on the Average True Range (ATR). This means that when the market is highly volatile, the AI automatically reduces the "lot size" of a trade to keep the dollar-at-risk constant.

Risk Parameter | Archon v3 Default | Professional Rationale |

|---|---|---|

Risk Per Trade | 1.0% | Ensures 100 consecutive losses are required for liquidation |

ATR Multiplier | 3.0 | Spaces stop-losses to avoid "market noise" while capping risk |

Max Daily Loss | 4.0% | Acts as a circuit breaker during unpredictable market shocks |

Max Drawdown | 8.0% | Aligns with "Prop Firm" standards for capital preservation |

Regulatory Environment and Explainable AI

As AI trading has moved into the mainstream, regulatory bodies like the CFTC and NFA have intensified their oversight. The core regulatory message of 2025 is that firms cannot "outsource accountability" to an AI system.

A major regulatory trend in 2026 is the demand for Explainable AI. The "Black Box" problem—where a system makes a profitable decision but even its developers cannot explain why—is increasingly viewed as a systemic risk. Regulators are concerned that if thousands of bots simultaneously converge on a collusive strategy, it could lead to an artificial flash crash.

The Human-Machine Hybrid Approach

Despite the technical prowess of AI, the human element remains a significant variable. Academic evaluations from 2025 confirm that while AI outperforms humans in high-frequency environments, human-managed funds often retain an advantage during long-term upward market trends or recovery phases driven by policy speculation.

Trading Scenario | Winner | Rationale |

|---|---|---|

High-Frequency Scalping | AI Bot | Human reaction time (2-3s) is too slow for millisecond gaps |

Emotional Discipline | AI Bot | Machines do not feel "revenge" after a loss |

Breaking News (Policy) | Manual / Hybrid | AI often struggles with the "nuance" of human policy shifts |

24/5 Global Coverage | AI Bot | Humans require rest; forex markets do not sleep |

Integration of Sentiment Analysis and Multimodal AI

One of the most profound shifts in 2025 is the move from unimodal to multimodal AI. In the context of forex, this means the AI no longer looks at price charts in a vacuum. Multimodal systems incorporate Natural Language Processing (NLP) to interpret the "tone" of Federal Reserve meetings, the sentiment of social media discourse, and the implications of sudden geopolitical shocks.

NLP models analyze economic calendars and central bank speeches to identify "hawkish" or "dovish" shifts before they are fully priced into the market. For example, if an AI detects an increasing frequency of the word "inflation" relative to "growth" in a Fed transcript, it may preemptively adjust its USD exposure.

Future Outlook: Quantum Computing and Beyond

Looking toward the end of the decade, the integration of quantum computing and decentralized AI promises to further revolutionize the sector. Quantum machine learning has the potential to solve complex portfolio optimization problems in seconds that would take current supercomputers hours.

However, these advancements also raise ethical questions about market inequality. If the most powerful AI systems are only accessible to those with the capital to afford quantum-ready nodes or high-cost data feeds, the zero-sum nature of forex trading could become even more lopsided.

Strategic Recommendations for Implementation

Prioritize Local Execution: To minimize latency and maximize security, utilize systems that run natively (e.g., MT5 with ONNX) rather than relying on external API bridges.

Enforce Strict Risk Caps: Never trade without an automated "circuit breaker" such as a 4.0% daily loss limit or an 8.0% maximum drawdown control.

Evaluate via Sharpe, Not Win Rate: Demand performance data that includes the standard deviation of returns and maximum drawdown to ensure profitability is not a result of luck.

Adopt a Hybrid Oversight Model: Use the bot for 24/5 execution but manually intervene during "regime shift" events or major geopolitical uncertainty.

Stay Compliant: Ensure that any automated system includes documentation and testing logs that meet the increasingly stringent Explainable AI standards.

Conclusion

The integration of artificial intelligence into the foreign exchange market is no longer a peripheral trend; it is the fundamental infrastructure of 2026. The search for "forex ai trading" reflects a global shift toward a more disciplined, data-driven, and automated approach to wealth management.

For the professional trader seeking to navigate this landscape, the choice of technology is paramount. Systems that offer local execution, transparent risk management, and rigorous backtesting represent the gold standard for those who demand institutional results on a retail scale. As the market moves deeper into the era of agentic finance, the successful trader will not be the one who predicts the next pip, but the one who best orchestrates the machines that do.

The foreign exchange market remains a zero-sum game, but in 2026, the game is being played on a digital chessboard where AI is both the player and the referee. By aligning with sophisticated architectures and adhering to the strict discipline of risk-adjusted returns, market participants can finally close the gap between their ambitions and the relentless reality of the global markets.